Then, debit the Cash account and credit the Customer Deposits account for the amount of the advance payment. When the work is completed, invoice the customer with the advance payment subtracted from the total cost. For more tips from our Financial co-author, including how to post advance payments to company reports, read on. A cash advance received from customer journal entry is required when a business receives a cash payment from a customer in advance of delivering goods or services. This type of situation might occur for example when a business demands cash in advance to pay for materials on a large or bespoke order or as a rental deposit on a property. To ensure the security of advance payments, businesses can take several measures.

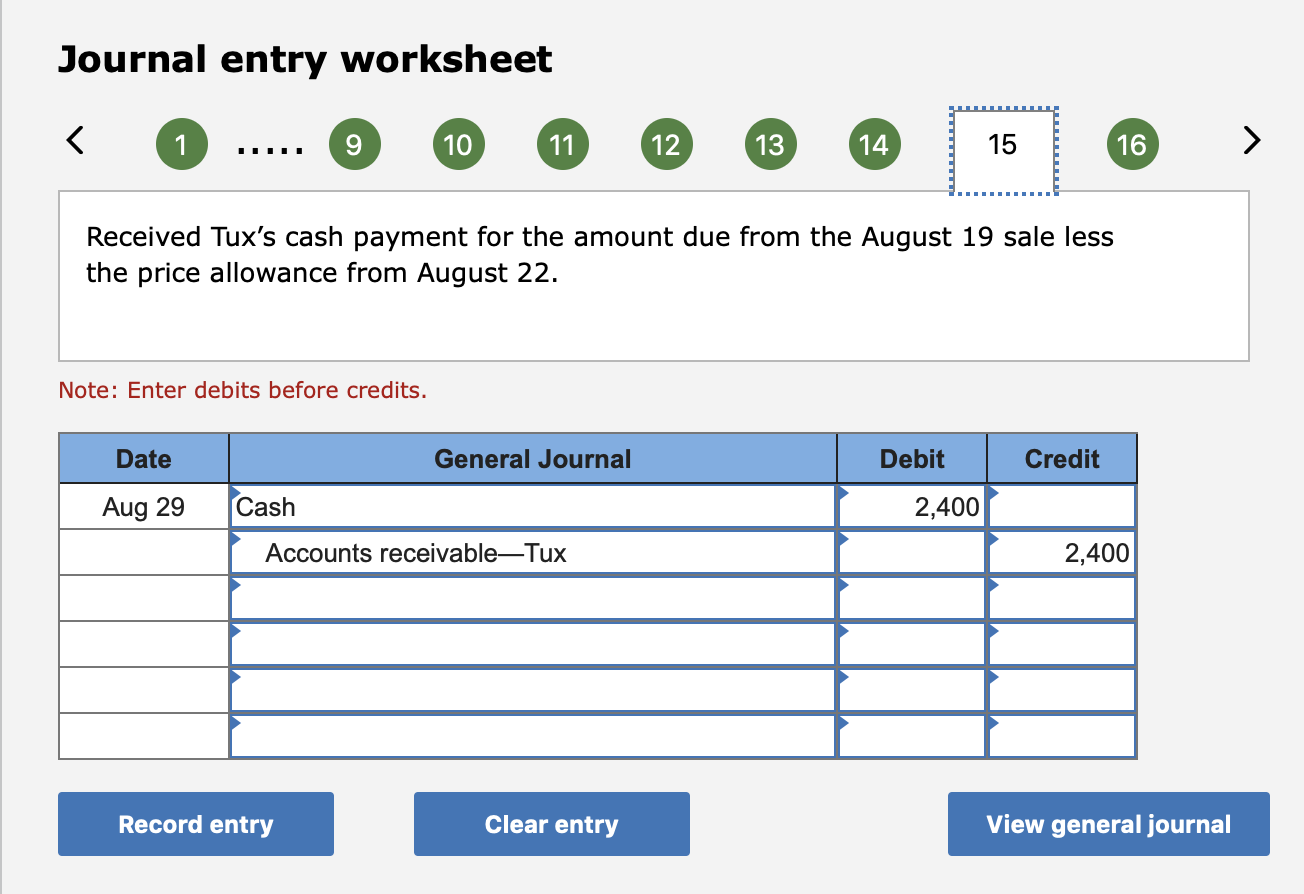

- They should make journal entry by debiting customer deposits, accounts receivable,s and credit sale revenue.

- In this guide, we’ll cover what advance billing is, the benefits of this billing method, and how to process advance payment.

- On 01 April, the customer place order and make a deposit to the company ABC.

- And as the company requesting the work, you should make sure the supplier has purchased all the materials before they begin working, you would have given them the money to do so.

- It prevents the customers from placing the order and canceling it later.

How to Account for Advance Payments

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation irs extends 2020 form 1095 furnishing deadline and other relief videos. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

FAQ’s on Customer Advance Payments

The journal entry is debiting accounts payable $ 70,000 and credit cash $ 70,000. The advance will be reversed when the purchase transaction is completed, it depends on the agreement between buyer and seller. Most of the time, the cash-paid advance will be settled with the amount purchased. The customer needs to pay the remaining balance at a certain point. It will increase the advance which is the current assets on the balance sheet.

Related AccountingTools Courses

It is advisable to have written agreements or contracts in place that outline the terms and conditions of advance payments. However, businesses should also be aware of consumer protection laws and regulations that may apply, depending on the nature of the business and the customer involved. This will move the unearned amount from the balance sheet as it can now be directly tied up with an invoice number allocated to the customer account. Should the amount be reflected as earned income on the income statement, it can now be moved against the invoice.

Journal Entry for Cash paid in Advance

In this guide, we’ll cover what advance billing is, the benefits of this billing method, and how to process advance payment. Income received in advance refers to a situation where a business has received a payment for a service that it has not yet rendered. An advance payment is seen as expenditure spent and both sides need to qualify the payment.

In this case, the customer may willingly pay early, with no prodding from the seller. A product may be so customized that the seller will not be able to sell it to anyone else if the buyer does not pay, so the seller demands advance payment. This is particular concern when the cost of the materials required to assemble the product is substantial, so the seller would incur a notable loss if the buyer were not to pay. Customer advance account is shown on the liability side of the balance sheet as the related revenue is still unearned.

Likewise, the journal entry for receiving the advance payment from the customer will increase both our total assets and total liabilities on the balance sheet. And only when we have delivered goods to the customer or performed the service for such advance payment, should we recognize the revenue and eliminate the recorded liability accordingly. In business, we may receive an advance payment from our customers for goods or services that we are going to provide them in the near future. If your company receives revenue in advance, it’s important to ensure that it is properly accounted for. The accrual accounting method dictates that revenues received before they are earned (by the product being delivered or the service being rendered) are reported as a liability. When advance payments are earned within a year (as is usually the case), they need to be listed as current liabilities.

The company wants to ensure that customers are willing to make purchases. It prevents the customers from placing the order and canceling it later. It will be a problem if the products are unique and build specifically for the customers. So if the customers cancel the order after the production is completed, the supplier will be stuck with the products as it is hard to find the buyer to fit with the product specifications. When the supplier delivers the machinery, ABC needs to record the fixed assets on balance sheet.