Consequently, it may not give a complete picture of a company’s overall profitability or financial health. Analysts should consider other metrics, like net income or EBITDA, to comprehensively understand a company’s performance. The operating income formula calculates operating income by deducting operating expenses from gross income. On the other hand, the EBITDA formula stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s profitability by adding back non-operating expenses and depreciation to operating income.

Operating Income Formulas and Calculations

Operating profit can give you insight into how well a company is run and whether or not it is profitable. It can also help you compare different companies to see which is more efficient. Additionally, operating profit margin is a key metric for investors and creditors when considering whether or not to invest in or loan money to a company. Sales revenue is the value of generated sales of goods and services from normal business operations during a set period of time. Last, the company is reporting a very material increase in provision for income taxes as Apple, Inc. estimated an additional $1 billion of expenses from what had been incurred one year ago. Because this expense is not directly tied to operational functions of the company, this increase has no bearing on operational income (though it does factor into net income).

Our Team Will Connect You With a Vetted, Trusted Professional

Gross profit is the profit made from a company’s main activities, after deducting the cost of goods sold but before deducting any other operating expenses. Net profit is the amount of profit left over after all business expenses have been paid. The operating profit margin is the ratio of operating profit to total revenue, and it is used to measure a company’s profitability and efficiency. It is calculated by taking a company’s revenue and subtracting the cost of goods sold (COGS) and operating expenses.

Get in Touch With a Financial Advisor

- In this equation, the standard price is the amount you expect to pay for per unit of direct materials, and the actual price is the price which you paid per unit for direct materials.

- Knowing your company’s operating income enables you to guarantee payback assurance to the financial institutions.

- It measures a company’s profitability by adding back non-operating expenses and depreciation to operating income.

- Accounting software such as QuickBooks, Xero, FreshBooks, and other QuickBooks alternatives can help businesses calculate their operating income quickly and in real-time.

- Because of their dynamics and production process, some industries are more capital intensive as compared to others.

- The operating income formula calculates operating income by deducting operating expenses from gross income.

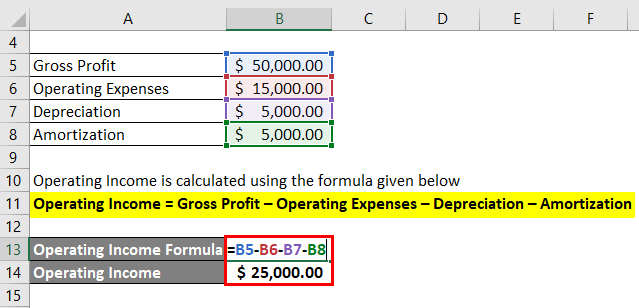

There are different ways to calculate a company’s operating income, but let’s talk about direct and indirect costs first. Derived from gross profit, operating profit reflects the residual income that remains after accounting for all the costs of doing business. The higher the company’s net operating income, the higher the chances of the company surviving in the future and paying debts and returns to the lenders and investors, respectively.

Operating income is also known as operating profit, and is sometimes referred to as EBIT, or Earnings Before Interest and Taxes. Below is a sample income statement to clearly illustrate the differences and locations of gross profit, operating profit, and net profit. EBITDA, on the other hand, will differ from operating income as operating income deducts depreciation and amortization expense. Let’s imagine a store called Linda’s Groceries, which had USD $1M in sales last year. Linda wants to understand if her business is profitable after deducting all the costs of running it. Operating income represents the profit a company has after paying for all expenses related to core operations.

How is operating profit different from gross profit and net profit?

In contrast, the net income formula calculates net income by deducting all expenses, including operating and non-operating expenses, interest, and taxes, from total revenue. Net income represents the company’s final profit after all expenses have been accounted for. Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s small business accounting bookkeeping and payroll profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business. Operating income—also called income from operations—takes a company’s gross income, which is equivalent to total revenue minus COGS, and subtracts all operating expenses.

Operating income is listed on a company’s income statement, which can be found on the SEC website and the company’s investor relations page. You can find the income statements of all publicly traded companies for free online, both on the SEC website and the companies’ investor relations pages. Operating income is often confused with earnings before interest and taxes (EBIT). An investment shall be accepted if the ROI exceeds a set benchmark, such as cost of capital or industry standards. The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out. As brief as this approach is, it tells us a lot about Joe Woods Gadgets Company.

These would be capital structure expenses like interest, taxes, and other expenses or sources of income such as investments not related to the core business. When you monitor a company’s operating income, you can deduce the efficiency of the core operations. Operating income is another section of calculation that shows a deeper understanding of the company’s operational success. In this article, you will learn everything you need to know about operating income. You will learn what it means, how to calculate it, and its overall importance for businesses.